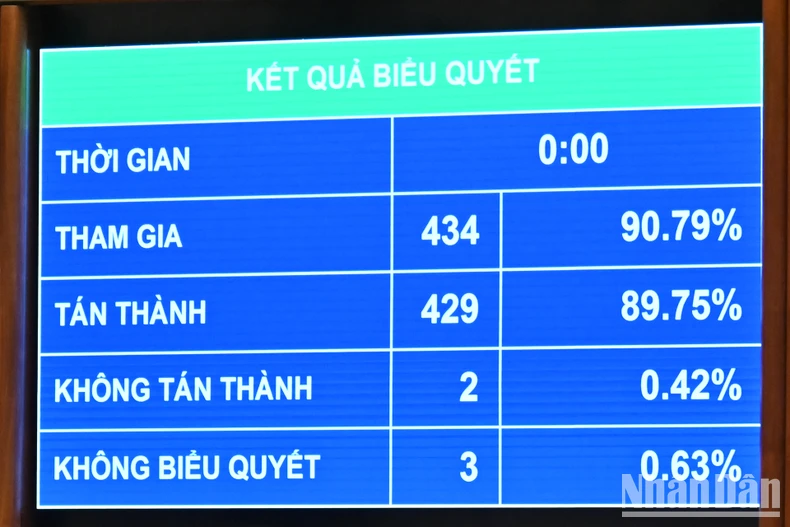

On the morning of May 17, with 429 out of 434 delegates present voting in favor, the National Assembly passed a Resolution on several special mechanisms and policies to promote the development of the private economy.

|

| “National Assembly deputies voted to pass the National Assembly’s Resolution on several special mechanisms and policies to promote the development of the private economy. (Photo: THUY NGUYEN) |

The Resolution comprises 7 chapters and 17 articles, stipulating provisions on improving the business environment; supporting access to land and production premises; providing financial, credit, and public procurement support; promoting science, technology, innovation, digital transformation, and human resource training; and assisting in the establishment of medium and large enterprises as well as pioneering businesses.

Elimination of Lump-sum Tax for Household Businesses from January 1, 2026

Previously, in presenting the report on feedback, explanation, and revisions to the draft Resolution, Minister of Finance Nguyễn Văn Thắng emphasized that the draft had been revised to move the effective date for abolishing the lump-sum tax regime for household businesses to January 1, 2026, instead of the originally proposed July 1, 2026.

At the same time, to reduce cost burdens and encourage digital transformation among household businesses, the draft Resolution stipulates that the State will allocate funds to provide free digital platforms and shared accounting software for household businesses.

Tax and Fee Support

The Resolution specifies that corporate income tax (CIT) will be exempted for two years and reduced by 50% for the following four years on income from innovative start-up activities carried out by innovative start-up enterprises, venture capital management companies, and intermediary organizations supporting innovation. The timing for tax exemption and reduction will follow the regulations of the Law on Corporate Income Tax.

Personal income tax (PIT) and corporate income tax will be exempted for income derived from the transfer of shares, capital contributions, rights to contribute capital, rights to purchase shares or capital contributions in innovative start-ups.

A two-year PIT exemption and a 50% reduction for the following four years will also be applied to income from salaries and wages of experts and scientists working at innovative start-ups, research and development centers, innovation hubs, or intermediary support organizations.

Small and medium-sized enterprises (SMEs) will be exempted from CIT for three years from the date they are first granted a business registration certificate. Also, business license fees will be abolished starting January 1, 2026.

Financial and Credit Support

Regarding financial and credit support, the Resolution specifies that private-sector enterprises, household businesses, and individual entrepreneurs are eligible for a 2% annual interest rate subsidy from the State when borrowing capital to implement green or circular economy projects, or projects that apply Environmental, Social, and Governance (ESG) standards, among others.

|

Voting results. (Photo: THUY NGUYEN) |

Priority Given to Civil, Economic, and Administrative Measures

The Resolution supplements principles for handling exhibits and assets during the investigation, prosecution, and adjudication of certain criminal cases, as previously stipulated in Resolution No. 164/2024/QH15 of the National Assembly, now extended for general application to all enterprises.

Specifically, the handling of evidence and assets must be timely and effective, without affecting the verification and resolution of the case; efforts should be made to remedy damages early and bring the assets into productive use, thus unlocking development resources and avoiding losses and waste.

It must ensure the interests of the State and the lawful rights and interests of organizations and individuals, and comply with international treaties to which Vietnam is a party.

The Resolution emphasizes the need to clearly distinguish between the responsibilities of legal entities and individuals when addressing violations; between criminal, administrative, and civil liabilities; and between administrative and civil responsibilities.

For civil and economic violations, priority shall be given to applying civil, economic, and administrative measures first; enterprises, household businesses, and individual businesspersons are encouraged to proactively remedy violations and damages. If the application of the law could potentially lead to criminal prosecution or not, criminal measures shall not be applied.

If the violation reaches a level requiring criminal prosecution, priority should be given to timely, proactive, and comprehensive economic remedies, which will serve as an important basis for the competent authorities to consider when deciding whether to prosecute, investigate, or adjudicate the case and apply further legal actions.

Retroactive application of legal regulations that negatively affect enterprises, household businesses, or individuals shall not be allowed.

In cases where information, documents, or evidence are insufficient to conclude that a legal violation has occurred, authorities must issue a timely conclusion in accordance with procedural law and publicly announce the conclusion.

The principle of presumption of innocence must be ensured throughout the investigation, prosecution, and trial processes.

The sealing, seizure, and freezing of assets related to a case must comply with proper jurisdiction, procedures, scope, and authority, and must not infringe upon the lawful rights and interests of organizations or individuals. The value of sealed or seized assets must correspond to the estimated damage in the case. Necessary and reasonable measures must be applied to safeguard asset value and minimize disruption to business operations, based on consensus from procedural authorities and without affecting the investigation process.

A clear distinction must be made between legally formed assets and those gained through unlawful acts or otherwise related to the case; and between the assets, rights, and obligations of an enterprise and those of the individuals managing it, in handling violations and resolving cases.

The Resolution on special mechanisms and policies to promote private economic development takes effect from the date it is adopted by the National Assembly.

Source: Bao Nhan Dan

Leave a reply